Criminals in some cases prey on SDIRA holders; encouraging them to open accounts for the goal of generating fraudulent investments. They typically idiot traders by telling them that In case the investment is acknowledged by a self-directed IRA custodian, it should be legit, which isn’t true. Once more, Make sure you do extensive research on all investments you decide on.

Constrained Liquidity: Most of the alternative assets that may be held within an SDIRA, such as real estate, personal fairness, or precious metals, may not be easily liquidated. This may be a concern if you'll want to accessibility funds immediately.

Opening an SDIRA can present you with use of investments Commonly unavailable by way of a financial institution or brokerage agency. Here’s how to start:

When you finally’ve observed an SDIRA service provider and opened your account, you may well be wondering how to really get started investing. Knowing equally The foundations that govern SDIRAs, and how you can fund your account, will help to lay the muse for just a way forward for profitable investing.

While there are lots of Advantages associated with an SDIRA, it’s not without the need of its possess downsides. Some of the popular reasons why buyers don’t decide on SDIRAs contain:

Real estate is among the preferred options among SDIRA holders. That’s since it is possible to put money into any kind of real-estate by using a self-directed IRA.

Be in charge of the way you increase your retirement portfolio by using your specialised understanding and passions to invest in assets that fit with all your values. Acquired knowledge in real estate or personal fairness? Use it to support your retirement planning.

Selection of Investment Selections: Ensure the provider enables the categories of alternative investments you’re thinking about, which include real estate property, precious metals, or private fairness.

And because some SDIRAs which include self-directed traditional IRAs are topic to expected minimum amount distributions (RMDs), you’ll ought to plan in advance to make sure that you've got enough liquidity to satisfy the rules established via the IRS.

Put merely, in the event you’re seeking a tax effective way to create a portfolio that’s additional personalized towards your pursuits and experience, an SDIRA may be The solution.

Whether or not you’re a money advisor, investment issuer, or other monetary Qualified, explore how SDIRAs can become a strong asset to increase your business and obtain your Expert objectives.

As an Trader, however, your choices are certainly not limited to shares and bonds if you decide on to self-direct your retirement accounts. That’s why an SDIRA can remodel your portfolio.

Many traders are shocked to learn that applying retirement money to speculate in alternative assets has actually been attainable because 1974. However, most brokerage firms and financial institutions focus on giving publicly her comment is here traded securities, like shares and bonds, simply because they lack the infrastructure and expertise to manage privately held assets, for example real estate or private equity.

This involves knowledge like it IRS restrictions, taking care of investments, and averting prohibited transactions that could disqualify your IRA. A lack of data could result in costly mistakes.

In case you’re searching for a ‘set and forget’ investing approach, an SDIRA likely isn’t the correct preference. As you are in full Handle about each investment manufactured, It is really your choice to execute your own personal research. Don't forget, SDIRA custodians are usually not fiduciaries and can't make tips about investments.

No, You can't invest in your own personal enterprise using a self-directed IRA. The IRS prohibits any transactions in between your IRA and your individual organization since you, given that the proprietor, are considered a disqualified human being.

Sure, real estate property is among our clients’ most popular investments, often termed a real estate IRA. Customers have the option to invest in every little thing from rental Homes, business real-estate, undeveloped land, home finance loan notes plus much more.

A self-directed IRA can be an very effective investment car, but it really’s not for everyone. As being the declaring goes: with excellent electricity will come good accountability; and with the SDIRA, that couldn’t be more legitimate. Keep reading to find out why an SDIRA could possibly, or may not, be for you.

Complexity and Responsibility: By having an SDIRA, you have more Management around your investments, but You furthermore may bear a lot more duty.

Michael Bower Then & Now!

Michael Bower Then & Now! Andrea Barber Then & Now!

Andrea Barber Then & Now! Mike Vitar Then & Now!

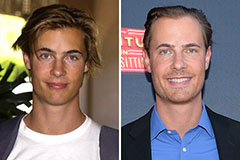

Mike Vitar Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!